A facility to write-off bad debts was introduced with Vitalware 2.5. A debt is considered bad when a product has been issued to a customer but full cost recovery has not been achieved and is deemed to be unachievable or not worth pursuing economically. Reasons for writing-off a debt are varied, but can include a disputed charge on an invoice or an under payment (<= the amount specified by a Maximum Under Registry entry) for an order. Writing-off the debt allows the POS transaction to be completed.

Note: The Can Write Off Registry entry specifies who is able to write-off bad debts.

Depending on whether a transaction has been invoiced or not a bad debt is written-off in one of two modules:

Note:

The Pos>Write-Off Shortfall Menu option will only display for authori

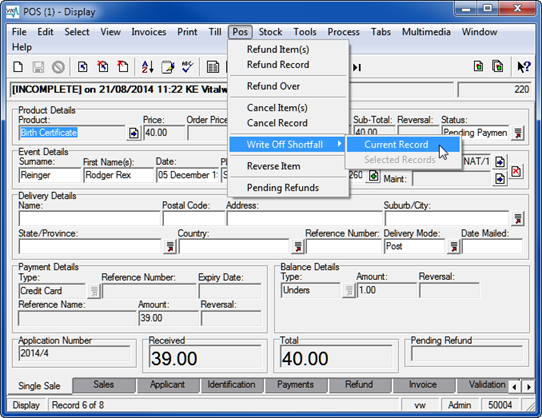

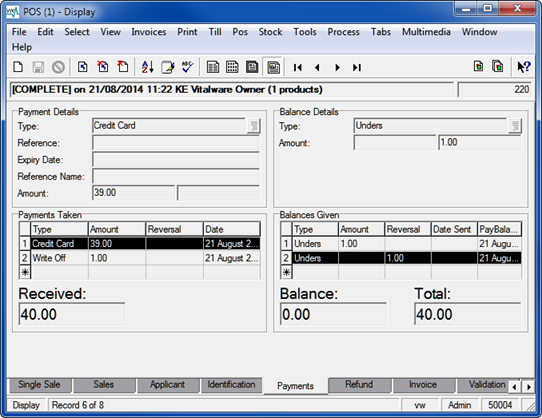

If a transaction has not been invoiced, the bad debt is written-off in the POS module.

Authori

Selecting this option will write-off the outstanding debt and (in the majority of cases) complete the POS record(s). The amount written-off will appear as a payment on the Payments tab of the POS record(s):

Note:

The Invoice>Write-Off Shortfall Menu option will only display for authori

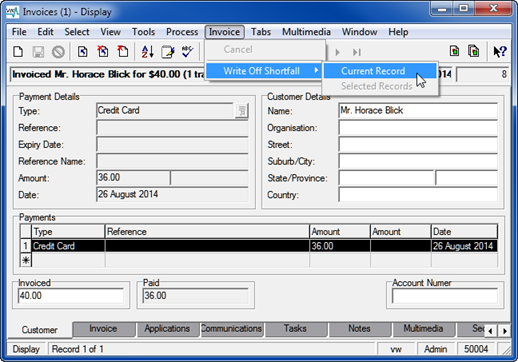

If a transaction has been invoiced (see How to invoice a sales transaction for details), the bad debt is written-off in the Invoices module.

Authori

Selecting this option will write-off the outstanding debt and update the Invoices record:

Any POS records associated with the invoice that are not fully paid (typically the last transaction) will be updated to reflect the write-off: